Golden Rule Program

Specialized portfolios designed to meet your needs.

The Golden Rule Program (GRP) is LexAurum’s internally managed investment solution, making cost-efficient, professional management available for most accounts. After assessing your goals, time horizon, and tolerance for risk, your financial advisor will recommend a portfolio based on your individual needs.

GRP portfolios primarily use low-cost ETFs to gain exposure to various asset classes. The underlying assets consist mostly of stocks and bonds, but may include other types of securities. For investors with longer time horizons and higher risk tolerances, higher stock weightings typically make more sense. Many of the ETFs we use trade at no cost on the Charles Schwab platform, reducing costs and aiding clients’ long-term returns.

Portfolio Management Process:

Step 1: Allocate – Portfolios are diversified across and within multiple asset classes based on client needs. The purpose of this process is to seek the maximum return for the client, given their stated level of risk.

Step 2: Review – Accounts are monitored to help ensure that the allocation remains appropriate. Changes in economic outlook, asset valuation and other factors are tracked.

Step 3: Rebalance – Rebalancing is performed on a discretionary basis when an asset deviates substantially from its prescribed allocation.

Portfolio Management Philosophy:

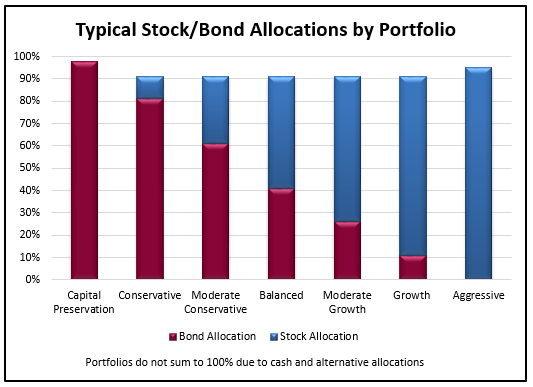

Strategic Asset Allocation - GRP portfolios are strategic, meaning that we will not try to jump in and out of the market based on short-term market predictions. Instead, allocations for each portfolio will usually remain within predetermined equity “bands,” such as those shown in the graph. The goal is to obtain the investment return of these asset classes, not create return through trading techniques. Portfolios are diversified in terms of asset class, geography, market cap, etc.

With a Tactical Twist - Although we believe that markets are normally efficient, there are moments where certain assets become very popular or fall deeply out of favor. Under these circumstances, GRP portfolios may tilt modestly away from asset classes perceived to be expensive, and towards assets that seem inexpensive based on historic averages.

Example: The GRP Aggressive portfolio typically has an equity allocation of about 95%. However, if it appeared that U.S. large cap stocks were trading at extremely high valuations, the equity allocation might be reduced to the low end of the model’s predetermined range. Furthermore, the equity weighting might be distributed more towards foreign-or-small-cap stocks, rather than U.S. large caps.

GRP FAQs:

Minimum Account Size: None

Tax Considerations: For nonqualified accounts, decisions will be made with tax consequences in mind.

Active or Passive: The Program is actively managed, but uses primarily passive, index-based ETFs.

There are eight portfolios: Seven emphasize total return; the High Income Portfolio focuses on Current Income.

Rebalancing Frequency: Portfolios will be reviewed for rebalancing quarterly or at the manager’s discretion.

No trading strategy can guarantee a profit or specific rate of return. GRP portfolios are subject to market risk, interest rate risk, credit risk, currency risk, political risk, liquidity risk, etc.